What is GST?

GST stands for Goods and Services Tax. GST is imposed on value added goods and services that are sold for domestic consumption. GST has replaced many indirect taxes in our nation. It was enforced on 29th March, 2017 and came into effect on 1st July 2017.GST is paid by the consumers but is remitted (to the government) by the enterprises selling goods and service. GST generates revenue for the government.

GST is the multi-stage, comprehensive, destination-based tax that is imposed on every value addition.Simply put, GST is an indirect tax imposed on the goods and services. GST has replaced many indirect taxes.

GST = one indirect tax for the entire nation.

Example: Let us consider the example of a biscuit manufacturer for understanding “What is GST?”The biscuit manufacturer buys flour, sugar and other ingredients. He makes biscuits from it and thus adds value to it. Then it goes to the warehouse where it is labeled. There is value addition here too! Finally, the retailer packs these biscuits in small packets and does some marketing for the same. GST will be imposed on these value additions. The monetary worth increased at each stage will be taxed and levied on the buyer of the end product.

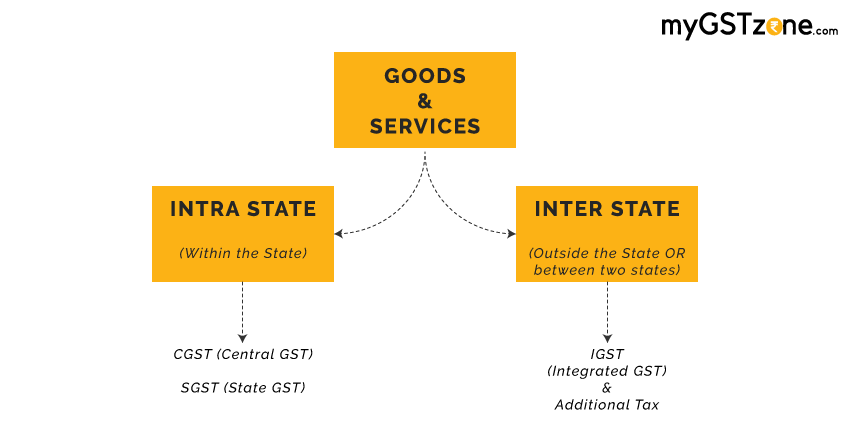

Breakdown of GST:

Let us now decipher“What is GST?” by breaking down GST into its constituent parts.

CGST – Central GST – Levied by the Central Government towards a sale occurring within the state

(Eg: Within theStates of India)

SGST – State GST – Levied by the State Government towards a sale occurring within the state

(Eg: Within the states of India)

IGST – Integrated-State GST – Levied by the Central Government towards a sale occurring between two states (Eg: Goods from one state sold to another state in India)

The below table helps us to comprehend “What is GST?” based on the transactions:

| Transaction | Tax During Present Government | Tax During Previous Government | More information |

| Sale within State | CGST + SGST | VAT + Central Excise/Service tax | Tax revenue is shared by both the union and state governments equally |

| Sale to another state | IGST | Central Sales Tax + Excise/Service Tax | For inter-state sales, only one kind of tax levied – Central. The union government will then share that revenue depending on the destination of the goods. |

For instance: Let us assume that a dealer in Chennai has sold goods worth 50,000 INR to a dealer in Bangalore. Only IGST will be imposed on this transaction. 18 percent IGST, that is, 9,000 INR will be collected by the Central Government from the dealer in Chennai.

The same dealer now sells goods (with the same) worth, 50,000 INR to a consumer within Chennai. The GST imposed on this transaction will be 12 percent. That amounts to 6,000 INR which will be split equally between the Union Government and the Chennai government (6 percent or 3,000 INR each).

GST in India: Now, let us know more on“What is GST?” in our Indian context.India is home to 1.3 Billion people and is one of the fastest growing economies in the world. According to Brookings institution of America, the economy of an average urban state of India ranged from $167 to $370 billion in 2016. Although India’s GDP was hit by GST initially, traders have realized the advantages of GST off-late. Most welcomed the online mode of taxation as it was quick and transparent.But, traditional traders who were not tech-savvy were found wanting. Earlier we had a cascading effect or ‘tax on taxes’. With the onset of GST, India has overcome this effect and there will be no more ‘tax on tax’.But you need not worry about your GST needs any more thanks to MyGSTzone.They will do the job for you, If you are a business owner in India we suggest you to opt for MyGSTzone for a painless transition to GST enabled business.

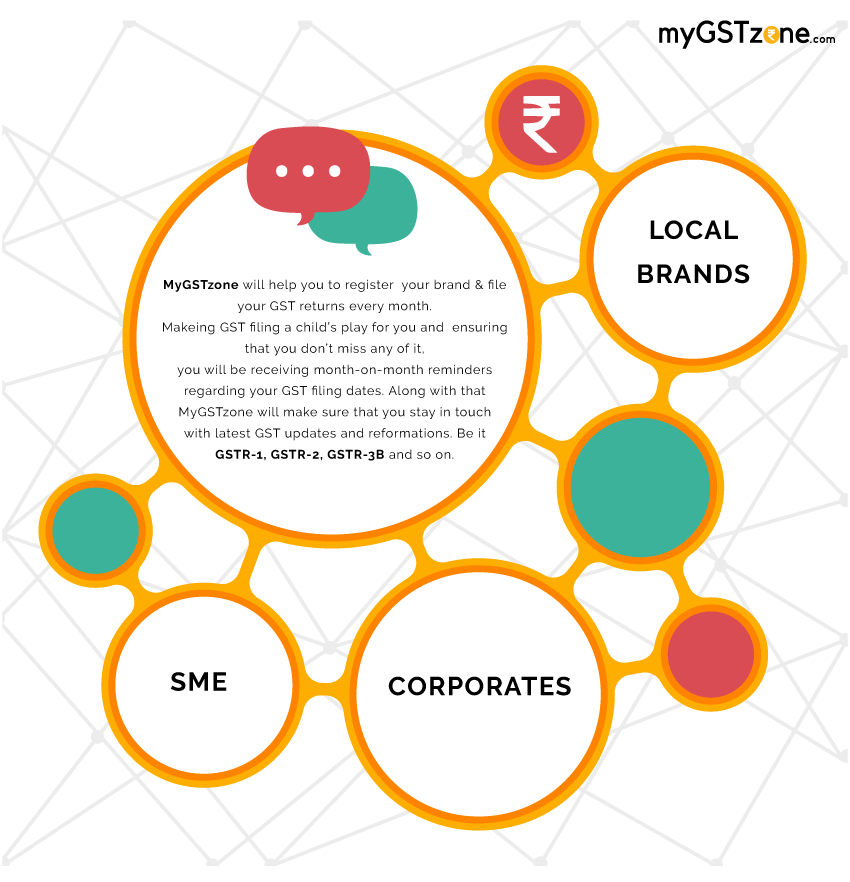

Are you a Local brands / SMEs / Businesses / Start-ups in Chennai or rest of India?

If you are a small or medium business looking to get your enterprise registered for GST, then you can delegate it to MyGSTzone. For any trade or business in Chennai, getting your GST registration is a very important thing. MyGSTzone will work on it on your behalf. This will make your business GST ready. If you are a start-up or a local brand, getting your GST number is mandatory to run your business legally and we would suggest you to entrust that responsibility to the experienced legal advisors at MyGSTzone.

How myGSTzone helps you to fast track your GST Registration and GST Filing?

MyGSTzone will help you to file your GST returns every month. They will send you reminders too and make GST filing a child’s play for you! Making sure that you don’t miss any of it, you will be receiving month-on-month reminders regarding your GST filing dates. Along with that MyGSTzone will make sure that you stay in touch with latest GST updates and reformations. Be it GSTR-1, GSTR-2, GSTR-3B and so on.

In the above article, we have tried to answer “What is GST?“. We have also analyzed its effect, mainly in the major Indian cities like Chennai, Bangalore, Kochi, Mumbai, Hyderabad, Bhubaneswar, Kolkata, Guwahati, Delhi, Lucknow, Patna, Indore, Ahmadabad, Surat, etc. We feel that GST has saved India from cascading effect (‘tax on tax’) while making the process transparent and quick. If you want to get your enterprise registered or you want a professional to manage all your GST returns, we strongly recommend – MyGSTzone. We are finally moving towards making GST – “Good and Simple Tax”, as tweeted by our Hon. PM Narendra Modi during its launch.