COMPOSITION RULES

Composition Scheme Rules encapsulates the procedural compliance w.r.t the intimation for Composition Scheme; the effective date for Composition Levy; Conditions and Restrictions on the levy; and Validity of levy and Rate of Tax.

A Small businessman who pay taxes and have an aggregate turnover of Rs. 50 lakhs in a financial year is eligible for composition tax. However, it is optional for the taxpayer. The Taxpayer needs to present the “Bill of Supply” to the Tax authorities instead of “Tax Invoice.” These individuals do not qualify for “Input Tax Credit.”

INTIMATION FOR COMPOSITION LEVY

I. To the people already registered under Pre –GST regime –

• Any person, who is granted registration on a provisional basis (registered under VAT Act, Service Tax, Central Excise laws etc.,) and opts for Composition Levy shall file intimation through FORM GST CMP-01 that is duly signed, before or within 30 days of appointed date. However, if intimation is filed after the appointed day, then the registered person cannot collect taxes and issue bill of supply for supplies.

• FORM GST CMP- 03 is also filled within 60 days of the exercise of option. It requires:

• Details of stock

• Inward supply of goods received from unregistered persons held by him on the date preceding the day of exercise of option

II. To people who have applied as a fresh registrant under GST –

• For fresh registration under the scheme, intimation in FORM GST REG- 01 must be filed.

III. To the individuals registered under GST and wants a switch to Composition Scheme

• Has to file a Intimation through FORM GST CMP- 02 for exercise option

• Statement must be given through the FORM GST ITC- 3 that contains details of ITC relating to inputs lying in stock, inputs contained in semi-finished or finished goods within 60 days of commencement of the relevant financial year.

EFFECTIVE DATE FOR COMPOSITION LEVY

I. The option to pay tax under Composition Scheme shall be effective on Appointed Day and during the time of Filing of Intimation.

- For persons already registered under pre-GST regime: Appointed Day

- Registered under GST and person switches to Composition Scheme: Filing of Intimation

II. To the people who have applied for fresh register under GST, the option to pay tax under Composition Scheme shall be effective from:

- When the application for registration has been submitted within thirty days from the day he or she becomes liable for registration, such date.

- In the above case, the effective date of registration shall be the date of grant of registration.

CONDITIONS AND RESTRICTIONS FOR COMPOSITION LEVY

I. The individuals who opt for the scheme must be neither a casual taxable person nor a non-resident taxable person.

II. The goods procured by him/her in stock should not be purchased from a place outside the State he/she resides. Therefore, the good shouldn’t be classified as:

• Interstate purchase

• Imported Goods

• Branch situated outside the State

• Agents or Principal situated outside the State

III. The taxpayers, who deal with unregistered person, should hold the stock or make them pay tax.

IV. There has to be Mandatory display of invoices that include words like – “composition taxable person, not eligible to collect tax on supplies.”

V. He or She should not be a manufacturer of such goods as may be notified by the Government during the preceding financial year.

VALIDITY OF COMPOSITION LEVY

The validity depends on the fulfilment of the aforementioned conditions. The option for opting out of the scheme is rendered to all the eligible people. They can conduct the same through filing an application. In few cases, the Proper Officer who believes that the taxpayer is not eligible for the scheme and has valid reasons or he the taxpayer has contravened any Rules or Act, then he may issue “show cause notice.” It is eventually followed by an order that denies the entailment of the scheme.

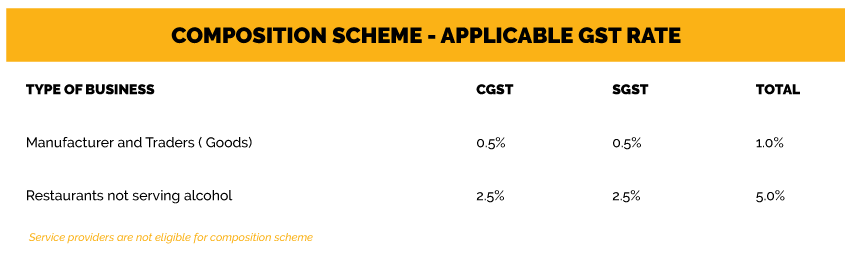

RATE OF TAX

The below table describes the different kind of rate of taxes for different categories of registered persons:

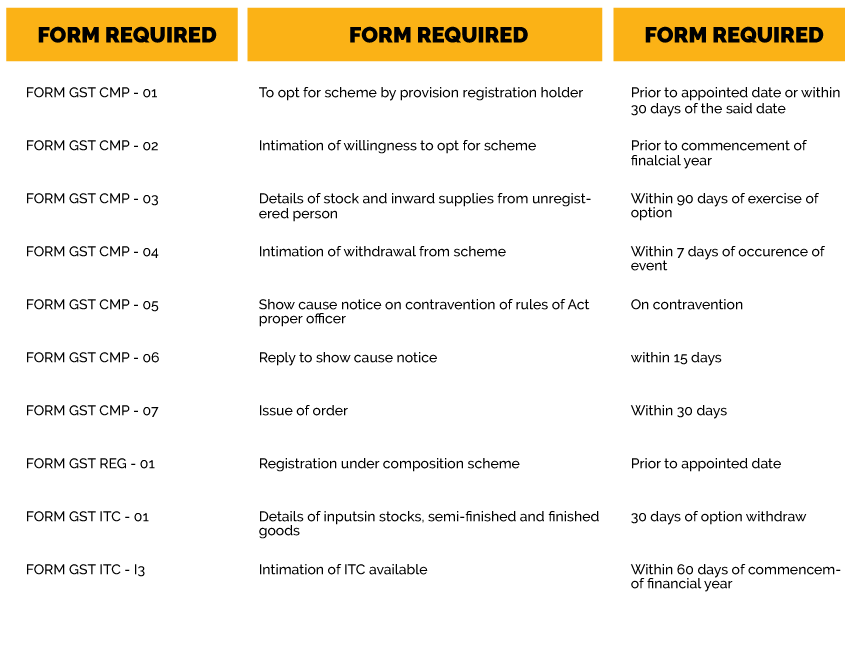

COMPOSITION SCHEME RULES UNDER GST – COMPLIANCE

Composition Scheme Rules under GST requires for submission of different forms for their respective purposes within the deadline. The following table describes the aforementioned information in detailed form:

All these forms should be duly signed, and filed electronically on Common Portal. The Commissioner notifies whether it can be done directly or through a Facilitation Centre.

PENALTY

Penalty equivalent to the tax is issued if there is misuse of the scheme.

CONCLUSION

Composition Rules are strict, rigid and to the point for the person to understand and avail the benefits of the Composition Scheme. Therefore, any person who opts for the scheme will be considered as opting for all the places of business, registered under the same PAN.