INTRODUCTION

Goods and Services Tax (GST), a One Nation One Tax concept, is an Indirect Tax that replaced a varied Indirect Taxes in India. On 29th March 2017, The Goods and Service Tax Act was finally passed. The Act was enforced and was implemented on July 1st, 2017. The Goods & Services Tax Law in India is an inclusive, stage-wise location-based tax. This tax has replaced the other indirect taxes.

To simply put it, this indirect tax is imposed based on the chain of supply. The Goods and Service Tax is one comprised indirect tax for the whole country. As per the GST regimen, at every point of sale, the tax will be imposed. Central GST and State GST will be imposed if intra-state sales are to happen, Inter-state sales will be charged with Integrated GST as there are two states involved.

India has been developing a sort of a reputation when it comes to introducing and reforming policies which are drastically affecting the economic structure of trading, business practices and other sectors directly or indirectly inter-linked via KYC or other sources. The government is coming up with a systematic order which helps to keep track of consumer’s activities, especially regarding trade. GST is one of the most prominent changes that took effect in the field of taxation where it rewrote and reformed tax levied on goods and services since it was enforced.

GST has replaced all kinds of indirect taxes and now is the sole indirect tax levied on supply of goods and services. It has replaced all other previous indirect taxes.

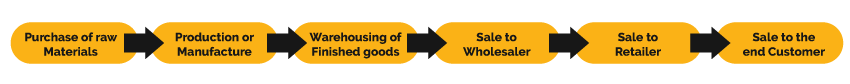

Stage-wise:

It can be expressed as stage-wise because of its nature. It is a series or process of supply chain for a unit. It begins and ends with the manufacture to final sale to the consumer.

To quote an example;

Goods and Services Tax will be charged accordingly on each of these stages, therefore it is called as makes it a multi-stage tax.

Value Addition

To quote an example, a car manufacturer buys components such as stereo, tires and other necessary parts. He then assembles a complete final unit and ultimately adds more accumulated value to it. It then it goes to the warehouse where it further undergoes external finishing. Hence, generating more value addition. Finally, the car is ready for transportation and further into the last stages of the manufacturing process. GST will be imposed on addition of value on goods and services. The worth increased at every stage will be taxed and levied on the purchaser of the end product.

GST will be charged on the basis these additions of worth/value.

Destination-Based

Suppose, the goods are manufactured in Gujarat and are sold to a consumer in Kerala. GST is charged on the final stage of consumption. So, in this case is, Kerala will be entitled to the entire revenue. GST is a location-based tax. Hence, end users consuming any sort of goods or services are liable to pay GST. The tax will be received by the state in which the trading takes place, not by the state where manufacturing takes place. When exports are considered, the tax is exempted.

THE COMPONENTS OF GST

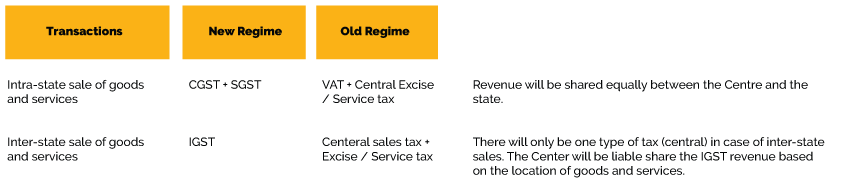

There are 3 taxes applicable under this system:

In most cases, the tax structure under the new regime will be as follows:

HISTORY OF GST

India adopted a new taxation policy that is – GST (Goods and Service Tax) – on July 1, 2017 through the implementation of One Hundred and First Amendment of the Constitution of India under the Indian Government. The idea of GST as a whole ‘One Country – One Tax’ had to experience a lot of hiccups, which generated a lot of disputes in politics.

However, the GST is successfully implemented under the Prime Minister Narendra Modi led Government. However, this was then again proven to be feasible and ready to for implementation if not for the ideas of leaders belonging to other opposite parties.

The most significant tax reformation since the early ’90s has been without a doubt the GST Act. Since the liberalization of Indian economy, it has been proved that GST prevailed as the most effective regimen.

A succinct of the GST journey since 2000 –

- 2000: The advisory panel consists of former RBI Governors such as Bimal Jain, IS patel, Jalan and C Rangarajan. Atal Bihari Vajpayee (Prime Minister at the time) forms a committee consisting lead by Asim Dasgupta (Finance Minister at the time.

- 2003: Under Vijay Kelkar to recommend tax reforms, Atal Bihari Vajpayee formed a task force

- 2005: As suggested by 12th Finance Commission, Kelkar committee recommended rolling out of GST

- 2006: Chidambaram set the date – April 1, 2010 as deadline for GST implementation

- 2009: Announcement of basic structure of GST as designed by Dasgupta committee was done by the then President, Pranab Mukherjee, Mukherjee retained 2010 deadline. However, BJP opposed GST Basic Structure

- 2010: Mission mode computerization of commercial taxes in state is commenced by the Finance Ministry for strengthening the foundation for Goods and Service Tax.

- 2011: Presentation of the Constitution Bill in the Lok Sabha for GST by UPA. Yashwant Sinha sent the GST Bill to the Parliamentary Standing Committee. Asim Dasgupta resigns from the post who is replaced by Sushil Kumar and then KM Mani.

- 2012: Chidambaram held a meeting setting December 31, 2012 as the deadline for rolling out GST.

- 2013: Chidambaram states in the budgetary speech that 9,000 crores are kept aside for losses incurred due to implementation of GST. In the Budget speech, Chidambaram says government has set aside Rs 9000 crore to compensate states for losses incurred because of GST. GST Bill is finalized to be introduced in the Parliament. In the year 2013, then Gujarat CM Narendra Modi opposes GST Bill. He states that 14,000cr worth of losses would incur every year.

- 2014: GST Bill lapses as new government comes to power.

- December 2014: Finance Minister Arun Jaitley introduced the GST Bill in Lok Sabha. Congress raises objection.

- February 2015: April 1st, 2016 is the date set as the deadline by Arun Jaitley. sets as the deadline for GST roll out.

- May 2015: Lok Sabha agrees to pass GST Constitutional Amendment Bill. Congress then sets the demands that the Bill should be sent to the Select Committee of Rajya Sabha.

- August 2016: Agreement to pass the Constitution Amendment Bill.

- September 2016: Eighteen states agree and give their consent to sign GST Bill within 15-20 days. To frame separate GST Bills Pranab Mukherjee forms GST Council.

- November 2016: A critical analysis of GST models in various countries took place before implementing it. The economies witnessed inflation in advanced countries when GST was introduced, to give consumer confidence and in order to avoid this and also– that prices of goods will not increase, that is why the government introduced the concept of anti-profiteering in GST.

- January 2017: Arun Jaitley declares July 1st, 2017 as GST roll out deadline.

- March 2017:Major four GST Bills are as follows –

- Central GST (CGST),

- Integrated GST (IGST),

- State GST (SGST) and

- Union Territory GST (UTGST) — which is passed by Lok Sabha and Rajya Sabha.

- May 2017:The Council of GST reveals four slab-rates for the regimen. GST Council unveils four slab-rates for GST regimes. The rates that were fixed are – 5, 12, 18 and 28%. More than 80% of goods of mass consumption either exempted or taxed under 5% slab.

- June 28, 2017: Mamata Banerjee announced she would skip midnight launch.

- June 29, 2017: Congress decided to skip launch.

- June 30, 2017 Midnight: GST is ready for rollout.

- July, 1, 2017: Implementation of GST

JULY

India entered a new Tax Regime under the Goods and Services Tax – GST – from July 1, 2017. In the beginning, many heads of major companies and industry heads of major companies and industry bodies took to twitter to express support for the sweeping tax reform.

The second day of GST saw over two lakh new assesses enrolling in the new pan-India indirect tax regime, the government said. “Second day after the roll out of GST with effect from 1 July has passed without any major problems being reported from the field,” a Finance Ministry release said. The release also explained, “Since 25 June, 2.23 lakh new dealers have entered the GSTN (GST Network) system by filing draft applications, of which 63,000 have also submitted full details, and of which 32,000 dealers granted fresh registrations also

The appeal came from the Revenue Secretary Hasmukh Adhia. In addition, the Secretary took to twitter to clear misconceptions regarding the new indirect tax regime. He also said that the implementation and execution of GST would be transparent. However, a dilemma existed as to how to tax various goods and services among retailers and customers.

- Merchants and trader who are achieving their trade value of below twenty lakhs or those who are dedicatedly engaged into supply of good and services which are excluded from taxation slab need not to register under GST. According to GST laws, A merchants / Traders had to register themselves under GST on or before 30th Of July, 2017. All Traders were requested to do follow the law without any fail. As stated by the Ministry of Finance.

- In order to induct more businesspersons into the new tax regime, the Government listed the benefits of being registered under GST. One of the advantage included that the input tax credit can be passed on in the value chain and due taxes collected will come to the exchequer. “Therefore, traders are requested to register under GST immediately without wasting any more time,” it said

- Government also announced that the Excise, VAT or service tax payers who have already migrated to the GSTN portal and have been issued provisional IDs need to complete the registration process by September 22, 2017, by giving all the documents following which GSTIN will be issued. It also announced that taxpayers who do not come under the ambit of GST Regime could cancel their registration by 22 July.

- Those taxpayers who have not migrated but are liable for registration, will have to register by 22 July, the government announced.

- For new taxpayers who are not registered under any of the erstwhile tax regimes, they will have to get themselves registered by 30 July 2017.

- If anytime during the course of the financial year a business crosses the Rs20 lakh turnover threshold, then it will have to apply for registration within 30 days from becoming liable for registration

The ministry of finance stated that if a business possesses a valid PAN, mobile number and e-mail ID then that person can file an application on the official portal. www.gst.gov.in for the sake of GST registration. Those who aren’t registered might attract penalty,” the Ministry added.

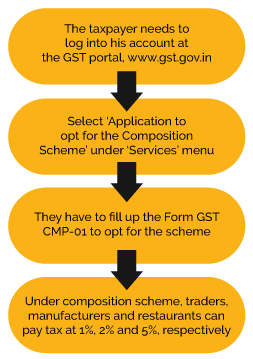

The government, however heading to confusion arised on the new tax regime, had extended the deadline until 16 August for businesses to opt for composition scheme under the goods and services tax (GST) regime. The Finance Ministry had issued a statement saying that in order to ease the compliance burden of provisionally migrated small taxpayers opting to pay tax under the composition scheme; it had decided to extend the time limit for filing intimation for composition levy up to 16 August 2017.

The Government had given time until 21 July 2017 to small businesses with turnover of up to Rs. 75 lakh to opt for the scheme in the GST regime. The Government came up with instructions to opt for the composition scheme,

The ministry also said that tax payers unwilling to cancel or get their GST registrations revoked, they could do so until 30th September 2017. By the end of July and August, there were over 70-lakh excise, value added tax (VAT) and service taxpayers who had migrated to the GSTN portal for filing returns in the new indirect tax – GST – regime. 8,00,000 + new taxpayers had registered on the portal.

The CBEC also had announced some clarifications,

Food that you order has tax at two rates – 12% and 18%. What tax is levied on your order – whether 12% or 18% – will be based on whether the restaurant is an AC restaurant or a non-AC restaurant, and whether it has the license to serve alcohol.

Non-AC, roadside eateries that don’t serve liquor along with the local delivery restaurants, will charge tax at 12%. However, the restaurants with full air-conditioning – both with and without alcohol –will charge tax at 18%. The tax charged at the non-AC eateries that serve alcohol will also be 18%. Non-AC, Eateries on the roadside that don’t serve liquor with the local delivery restaurants will charge 12%. But restaurants that serve with AC where they serve food and liquor will charge 18%.

GST Rate Finder app was launched for people who were dubious about the rates. The Government had introduced this to assist the taxpayers to help them locate the GST rates on specific goods and services.

AUGUST

The tax that was collected in the maiden filings was still being compiled. As the last filing date was not over yet. Indirect tax collections stood at 68,341 cr in July 2017. The department of revenue had collected around 65,000 from maiden GST.

The government had extended the deadline for filing returns by taxpayers availing transitional credit to August 28. However, they were required to self-compute their tax liability and pay it by August 25.

The government collected around Rs 60,000 crore in taxes in July, a senior government official told. The tax collected includes State GST, Central GST, Integrated GST as well as the cess levied on demerit goods. Around 32 lakh taxpayers had filed returns, which was the last day of paying taxes. This is compared to the 50 lakh taxpayers who successfully completed their registration on Good and Services Tax Network portal, the official said. We expect the remaining taxpayers to file returns by August 28, which is the last date for that availing input tax credit, the official said.

SEPTEMBER

The government had notified dates for filing GST returns for July and August according to the recommendations of Goods and Service Tax. Under the GST, three forms – GSTR 1, GSTR 2 and GSTR 3 – had to be filed every month. For the month of July, the three forms had to be filed between September 1 and 5, September 6 – 10 and September 11 – 15, respectively. According to a notification issued by the Government. For the month of August, the three forms had to be filed between September 16 – 20, September 21 – 25 and September 26 -30, respectively.

- Form GSTR 1 is associated with sales of a business,

- GSTR 2 is associated with purchases and

- GSTR 3 is associated with a combination of sales and purchases

The taxpayers along with the three forms had to file a form GSTR – 3B. GSTR – 3B is a summarized statement of purchase and sales. The GSTR – 3B form for July was to be filed by 20th August. Similarly, for August the filing had to be done by 20th September. The final date for September filing for forms GSTR 1, 2 and 3 was scheduled to be on 10th of October respectively. The delays resulted in a penalty. However, the industry had demanding for an extension of the filing date of GST returns.

The CBEC had

- Disregarded fee for filing of GSTR – 3B that resulted in a delay.

- Permitted business entity to rectify any errors in the first return filings whilst filing the final returns.

- Business entities who failed to file GSTR -3B could file the final returns in GSTR 1, 2 and 3 to pay taxes.

GST Council decided to levy only 10% of the total. Tax for rate on household items (30) was also lowered.

Some of the important takeaways from the GST Council:

1.Hike in Compensation Cess on Cars

The GST council increased the tax comprising of rate and cess on some categories of the automobiles to make sure that the imposing of tax resulted to be similar to the previous tax regimen when compared to the rates after GST was implemented.

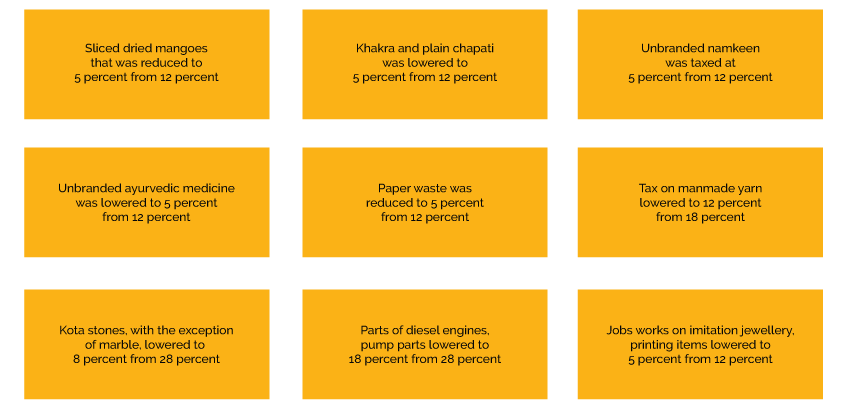

2. GST Rates Revised For 30 Items

Arun Jaitley also stated that the tax rate on some of the household items has been lowered. The following are the items.

- Dried tamarind

- Roasted gram

- Custard powder

- Idli and Dose batter

- Plastic raincoats (Reduced to 18 percent from 28 percent)

- Rubber bands (Reduced to 12 percent from 28 percent)

OCTOBER

Some of the Highlights of GST Council conducted in October include:

- Exporters got tax refunds by October 10 for July and by October 18 for August

- An e-wallet for exporters was created, and through it, a notional amount was advanced to them

- The e-wallet facility was set up by April 1, 2018

- A nominal GST rate of 0.1 percent was levied on exports till March 31

- GST exemption was provided to exporters until March 31

- Threshold for Composition Scheme in GST was hiked from Rs 75 lakh to Rs 1 crore

- Traders paid 1 percent tax, manufacturers had to pay 2 percent and restaurants owners had to pay 5 percent tax under the Composition Scheme

- Companies with turnover up to Rs 1.5 crore could file Quarterly Returns

- About 15.5 lakh companies had a turnover of less than Rs 1 crore and had joined the Composition Scheme

- Other taxpayers with turnover up to Rs 1.5 crore could file quarterly returns instead of monthly returns

- GST rates on restaurants was revisited where the Group of Ministers (GoM) decided if the taxes could be reduced when they are not able to avail the benefit of input tax credit.

The GoM looked into the following issues:

- Inter-state supply of goods for those who avail the Composition Scheme

- Exempted goods’ sale by traders availing the Composition Scheme

- Whether input tax credit can be availed if tax at the rate of 2 percent is paid

GST Rates Cut

Some of the 27 items including that GST council cut the rates include:

Exporters and small businesses got relief as the Goods and Services Tax Council in its 22nd meeting announced multiple measures to make transition to the new uniform indirect tax easier. A list of twenty-seven items was excluded by the Council.

On October 26th, the government chose to provide an extension for the deadline by one whole month that is until November 30th for the sole purpose of business to claim credit.

TRAN-1 was to be filed by businesses that claimed credit for taxes before the launch of GST.

Hyderabad was the place for the council’s twenty first meeting. In this meeting, extension of the deadline for filing TRAN-1 form to 31st October beginning from late September.

Some of the decisions made in the meeting were as follows:

- Leasing of vehicles purchased and leased prior to July 1, 2017 would attract GST at a rate equal to 65 per cent of the applicable GST rate (including compensation cess)

- Such vehicles when sold shall attract GST of 65 per cent of the applicable GST rate (including compensation cess)

- Sale of vehicles by a registered person who had procured the vehicle prior to July 1 and has not availed any input tax credits of central excise duty, VAT or any other taxes paid on such motor vehicles, would also be subject to 65 per cent of applicable GST rate (including compensation cess).

NOVEMBER

India’s goods and services tax collections took a dive to Rs 83,346 crore in the month of October, which proved to be more than Rs 90,000 crores in each of the first quarter. A statement was made by the finance ministry for lowering the collection which are mentioned as follows.

- The e of state and central GST out of integrated GST (IGST) paid in the first quarter,

- For the sake of reduction of taxes

- Goods and Service Tax payment based on self-declared tax return.

A Committee to address filing issues was commissioned. The Government decided to form a ten-member committee under Ajay Bhushan Pandey the GSTN chairman for the overview of requirements. for 2017. The committee consisted of tax commissioner from various states like Karnataka, Gujarat, Punjab and Andhra Pradesh. The only objective of this was to suggest to look over and recommend whether any changes that were likely to be made in the laws, rules and format department are required. By December 15, the committee had to submit its report.

The committee was set up on the recommendations of the GST Council. The council had decided to maintain and keep the filing of GSTR-2 i.e., purchase returns and GSTR-3 i.e., the matching of sales and purchase returns.

The last date for filing the summary returns without interest was by November 20. Around 14.7 lakh taxpayers who logged into the GST Network portal to file the summary returns; it created a new record for maximum returns filed in a single day.

GST aimed at creating a common nationwide market by scrapping a web of local taxes post the GST Council meeting that happened on 10 November, where it also slashed taxes on as many as 200 items to ease the burden on businesses, relaxed penalties and made it easier for small businesses to comply.

DECEMBER

The states experienced a GST revenue loss due to GST implementation worth 24,500 Crore during the months of July to October; Hence, the union relieved compensation to the states. According to the details mentioned during declaration of compensation on GST to states till 30th of November 2017, a list of states got maximum compensation from the central government such as Karnataka – 3,271 Crore INR, followed by Gujarat – 2,282 Crore and Punjab – 2,098 Crore. Many other states who also required a huge compensation were Rajasthan, Bihar, Uttar Pradesh. West Bengal and Odisha.

“…the revenue loss due to implementation of GST to the states for month of July to October has been estimated Rs 24,500 crore and the same amount has been released to the states as compensation to make up for the loss of revenue on bi-monthly basis for the month of July-August, 2017, and September-October, 2017,” Mr Shiv Pratap Shukla from Ministry of Finance – Minister of state wrote a reply in Lok Sabha and mentioned

Shukla said the GST anti-profiteering authority had received 169 complaints until December 26, 2017. The complaints were regarding alleging the Goods suppliers that they have not processed the benefit of cost reduction to the customers.

The GST Amendment Bill, 2017 related to compensation to states was aggressively passed by the Lower Houses. Which was directly related to the approval of the bill to increase the CESS on luxury vehicles from 15% to 25% in Lok Sabha, this was envisioned to enhance funds to relieve states for their revenue losses during the early phase of GST roll out.

Later to this Mr Arun Jaitley – Finance Minister mentioned that the amount which is collected due to the implementation of above bill regarding the increased cess on luxury vehicles and will be passed in the form of compensation for the loss in revenue occurred during the early stage of GST implementations. He also added that GST council, which consists of all state finance ministers will meet every month and discuss on balancing the taxes to avoid GST collections.

Where as members asked for further reduction of GST on number of products such as Sanitary Napkins, Handicrafts, Hand loom products, Sports goods and Agricultural equipment etc. Some also suggested that there must be a uniform and single tax slab instead of four.

According to the GST law, Construction of a complex architectural structure or a part of it, including building intended for sales and buying are considered under service industry and are liable to the GST. However, there will be no GST in case of ready to move in or completed property according to CGST ACT, 2017 and only applicable on structures which are under construction.

A complete set of 178 goods, including products belonging to day-to-day household usage were moved into 18% and 12% slab from the 28% slab to provide an ease to consumers. As per the directions from CBEC (Central Board of Excise and Customs) to their field officials states to keep a close tab on tax payments and transaction credit related to Taxation in the Input Tax credit and previous tax regime.Total GST collection during the month of November reached up to Rs 80,808 crore. Of the Rs 80,808 crore, Rs 41,270 crore was on account of integrated GST, Rs 18,650 crore was state GST and Rs 13,089 crore was central GST. Prior to all settlements and transactions, CGST and SGST collection from November reached 23,437 Crore INR and 33.138 Crore INR respectively, along with total cess compensation collection which accumulated to 7,798 Core INR.

The government had announced that 9.9 million taxpayers have been registered under GST until December 25. They also mentioned about total number of GST returns filed during month of November till December.

JANUARY

The center claimed they had collected a revenue in the month of January that is the total revenue collected under GST till the date – February 25 was around Rs 86,318 crore. According to the statements made by the Ministry of Finance “1.03 crore taxpayers have been registered under GST so far till 25th Feb, 2018. and 17.65 lakh dealers got registered as Composition Dealers,” Rs.19,961 crores have been collected as SGST, For the sake of CGST, Rs.14,233 crores have been collected. as IGST, Rs. 43,794 crores collected & as compensation is collected Rs. 8,331 crores collected.

The following statement was made regarding the collection of GST from Month of January “The GST collections for January are almost the same as that for December i.e. around 86,000 crores. The average GST revenue collections seem to have settled around Rs 86,000 crore. About 30% taxpayers registered with GST are still not filing their returns and the Centre must endeavour to make them file the returns, which may further enhance the overall GST revenue collections.” by Mr Abhishek Jain – Tax partner EY.

Out of 17.65 lakh dealers, 1.23 lakh Composition Dealers have chosen to adopt the Composition Scheme and have thus become regular taxpayers, as per the Ministry of Finance. “Till 25th Feb,2018 there are 16.42 lakh Composition Dealers which are required to file returns every Quarter & 87.03 lakh taxpayer to file monthly returns”.

The indicates that 69% of total taxpayers that was required to file monthly returns. For the month of January, 57.78 lakh GSTR 3B returns had been filed. – Later added the ministry.

The following statement was made by Pratik Jain, a Partner & Leader, Indirect tax.

“As roll out of E-way bills getting postponed to April 18 and a continuing shortfall in number of monthly returns getting submitted, we may see administrative get tighter and perhaps even more rigorous anti evasion measures in next few months,”

FEBRUARY

Collection of GST slid for the second time during the month of February to 85,174 Crore INR, since only 69% of the asssesess filed the GST returns. Near to 59.51 Lakh GSTR-3B returns were filed during this month, Which accounted to 69% of total taxpayer’s population who were supposed to file the Monthly returns according to the Ministry of Finance.

A direct reference from a statement mentioned by Ministry of finance “The total revenue received under GST for the month of February 2018 (received up to 26 March) has been 85,174 crore INR”

Out of 85,174 crore INR, which was the total GST collections during February, Rs14,945 crore was found to be from CGST and Rs 20,456 crore as SGST collection.

Apart from this, 42,456 crore INR and 7,317 crore INR was calibrated as IGST collection of the month and compensation cess. By the time of final settlement total amount of 25,564 Core was deposited into CGST/SGST account from IGST.

A further statement was added by Ministry of finance was “Thus, the total collection of CGST and SGST up to 26th March (for February) is Rs27,085 crore and Rs33,880 crore respectively, including transfers by way of settlement,”

Mr Abhishek Jain – EY partner mentioned that, “the next big hope for the government would be the introduction of GST e-way bills with effect from 1 April, which may provide a boost to GST collections. After the e-way bill roll out, transporters of goods worth over Rs50,000 will have to generate an e-way bill.” The e-way bill was touted as an anti-evasion measure and as a boost to tax collections as it would clamp down on trade that was taking place on the basis of cash transaction.

MARCH

By the end of March, Total count of GST registered tax payers reached 1.05 crore. Out of which 18.17 lakh were composition dealer ( only liable to file GST returns on a quarterly basis) and remaining 86.37 had to file their GST returns every month.

For the first time GST collection since implementation reached over 1 lakh crore during the month of April. According the Ministry of Finance gross revenue from GST was 1.03 Lakh Crore INR in April 2018. This calculation was based on total GST collection during the month of March. Some experts opine that E-way bills could curb tax evasion.

Mr Abhishek Jain – Tax partner EY again spoke about e-way bill, where he said “With anti-evasion measures like e-way bill already introduced and others like TDS, TCS (tax deducted at source, tax collected at source) and credit matching, which may get introduced in the coming months, the government could be hopeful of very good GST collections in the current fiscal year, that is 2018-19,”

“The cumulative compliance levels (percentage of returns filed till date) for initial months has crossed 90% and for July, 2018, has reached 96%.,” Government added a statement to compliment the figures achieved during this period.

APRIL

The amendment of E-way bill resulted in improvement in Compliance of GST in every aspect. Proof to the above statement is in the increase of collection and number of returns filed in the month of April. According to the E-way bill, Generating a E-way bill is mandatory for any transporter involved in moving goods of more than Rs. 50,000. It is a method to track the movement of goods, in order to curtail tax evasion. E-way bills were generated for both Inter as well as Intra state. However, E-way bills for inter-state goods came into effect from April 1, 2018, while the intra-state e-way bills were implemented April 15. However, from June 1, all states are mandated to implement E-way bills on Intra-State goods.

The total GST collection for the month of April 2018 (collected in May) stood at Rs 94,016 crore. Out of Rs 94,016 crore,

- CGST collections were Rs 15,866 crore,

- SGST collections were Rs 21,691 crore

- IGST was Rs 49,120 crore, this included Rs 24,447 crore collected on imports and cesses at Rs 7,339 crore.

Prior to these settlements, the total revenue calculated by government both Central and State during the month of May was calibrated at 28,797 crore and 34,020 crore INR for CGST and SGST respectively.

In concern to above mentioned, Ministry of Finance stated that “Though the current month’s revenue collection is less compared to last month’s revenue, still the gross revenue collection in the month of May (Rs. 94,016 crore) is much higher than the monthly average of GST collection in the last financial year (Rs 89,885 crore). The April revenue figure was higher because of year end effect.”

As a compensation for the month of March 2018, the Government on May 29 released Rs 6,696 crore to the states as GST.

MAY

Total GST collection during the month of May was reduced to Rs 94,016 crore, compared to the previous collection during April. Out of the total Rs 94,016 crore collected in May,

- Central GST collections stood at Rs 15,866 crore,

- State GST at Rs 21,691 crore,

- Integrated GST collections were Rs. 49,120 crore, which included imports – Rs 24,447 crore and cess collections – Rs 7,339 crore.

According to government and ministry of finance, the total number of GSTR 3B GST returns counted for April to May 31, 2018 reached 62.47 lakh.

The total revenue calculated for Central and State Government for the month of May was recorded 28,797 crore INR and 34,020 crore INR for the CGST and SGST respectively. The compensation released to states on May 29, 2018, was Rs. 6,696 crore.

CONCLUSION

GST i.e., Goods and Service Tax is a primary value addition tax which has come in place of all previous indirect taxes imposed on all domestic purchases. The GST Act was passed on March 29th 2017. The Act was enforced as on 1st of July 2017.

The Goods and Service Tax acts in place of all previous indirect taxes. It is a value addition tax which is now levied on supply of goods and services.

Unlike the previous taxation policy, GST allows the person registered under GST to avail Input Tax Credit if he satisfies particular conditions.

GST is the one and only indirect tax for the entire nation

In the regimen before Goods and Service Tax, all buyers (including the final consumer) used to pay tax on tax. GST prevents this from happening.

GST is generally technologically based all other activities like registration return filing; application done via online portal. This will accelerate the processes.

GST also brought one whole country-wide method of waybills by the introduction of E-way bills.

GST also introduced E-waybills which is a system of waybills. For the intra-state movement of goods, it took place on 15th April 2008. With this policy producers, transporters and traders are the ones benefiting by a general portal where e-bills can be generated. This took place on April 1st 2008 for inter-state movement of goods. Tax authorities have the upper-hand as this reduces the time at check-posts and helps reduce tax evasion.

For further queries on GST Compliance, GST Returns Filing, and anything related to GST, contact us at MyGSTzone, we will provide you with an efficient team who can address your queries.